Pension Plan

Pension Plan

The City of College Station participates as one of 900 plans in the multi-employer, nontraditional, joint contributory, hybrid defined benefit pension plan administered by the Texas Municipal Retirement System (TMRS). In a multiple employer defined benefit pension plan, each municipality pension is administered and governed by state, but each municipality are responsible for their assets and liabilities. College Station’s plan provides the following benefits to its employees:

BENEFITS PROVIDED

TMRS provides retirement, disability, and death benefits. Benefit provisions are adopted by the governing body of the City, within the options available in the state statutes governing TMRS. A summary of plan provisions for the City are as follows:

| Employee Deposit Rate: | 7% of Pay |

| Matching Ratio: | 2 to 1 |

| Vesting of Benefits: | 5 years |

| Service Retirement Eligibility: | 20 years at any age, 5 years at age 60 and above |

| Updated Service Credit: | 75% Repeating Transfers |

| Annuity Increases (to retirees): | 50% of CPI Repeating |

Employees Covered by Benefit Terms

At the December 31, 2023, valuation and measurement date, the following employees were covered by the benefit terms:

| Employees Covered by Benefit Terms | |

| Inactive employees or beneficiaries currently receiving benefits | 617 |

| Inactive employees entitled to but not yet receiving benefits | 736 |

| Active employees | 953 |

| Total | 2,306 |

PENSION SUMMARY

Pension commitments made by the City of College Station to its employees and funding the commitments to date, is determined by understanding 1) investments (management of the assets/TMRS responsibility), 2) actuarial valuations (calculation of the cost of benefits earned to date/TMRS responsibility) and 3) funding (the city’s commitment to make contributions to fund the benefits earned to date/City responsibility).

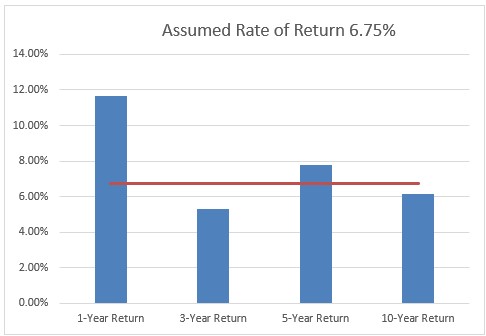

If the projected rate of return is not earned, assets will be less than expected and the City will have to make up the deficit through an increased contribution rate.

Additional information on actuarial policies including valuations and experiences studies validating assumptions used can also be found at the site above. If the actuarial assumptions used are unrealistic, the actual liabilities could be higher than projected and the City would be required to make up the difference through increased contributions.

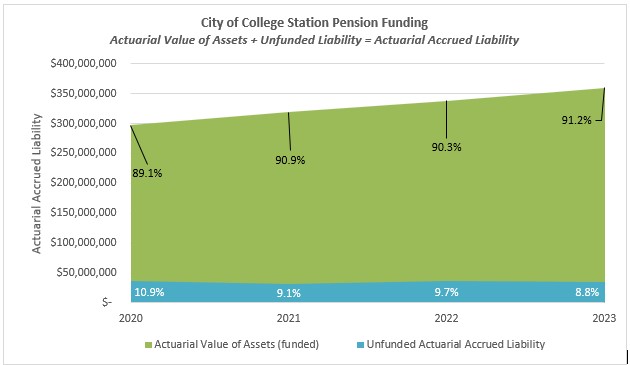

Our commitment and funded status for the pension liabilities is provided on this page and in the City’s ACFR, located here.

TMRS employs two separate actuarial valuations: 1) a funding valuation to calculate the city’s actuarially determined contribution and 2) the Government Accounting Standards Board (GASB 68) valuation which is used for financial reporting purposes and is reported in the city’s ACFR. The primary difference between the two valuations, is that the funding valuation uses a smoothed actuarial value of assets and the GASB 68 valuation utilizes fiduciary net position based on a market value of assets on the reporting date.

| Equivalent Single Amortization Period | 25 years |

| Covered Payroll | $72,824,353 |

| Funding Valuation (Smoothed Value) | 12/31/2023 | GASB 68 Valuation (Market Value) | 12/31/2023 | |

| Total Actuarial Accrued Liability | $394,364,775 | Total Pension Liability | $394,364,775 | |

| Actuarial Value of Assets | $359,504,546 | Plan Fiduciary Net Position | $357,554,989 | |

| Unfunded Actuarial Accrued Liability (UAAL) | $34,860,229 | Net Pension Liability (NPL) | $36,809,786 | |

| Funded Ratio | 91.2% | Funded Ratio | 90.7% | |

| UAAL as a percentage of covered payroll | 47.9% | NPL as a percentage of covered payroll | 50.5% |

Pension Actuarial Accrued Liability Data.xlsx - 17KB

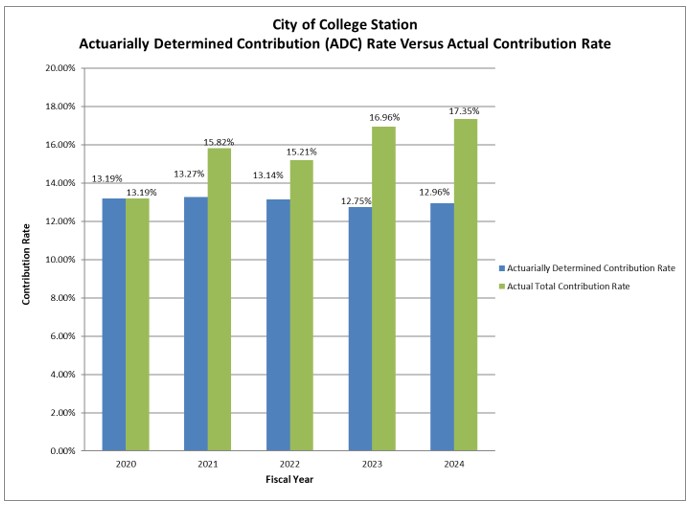

CONTRIBUTIONS

Employees for the City of College Station were required to contribute 7% of their annual gross earnings during the fiscal years. The contribution rates for the City of College Station are 12.65% and 13.05% in calendar years 2024 and 2023.

Pension ADC TCR Data.xlsx - 15 KB

INVESTMENTS

TMRS strategies and results are available in their Annual Comprehensive Financial Report (ACFR) in the investment section at TMRS • Financial Reports.

TMRS Assumed Rate of Return = 6.75%

| 2023 Investment Results (TMRS Total Fund Return) |

|||

| 1-Year Return | 3-Year Return | 5-Year Return | 10-Year Return |

| 11.64% | 5.29% | 7.79% | 6.15% |

| Source: TMRS 2021 Annual Comprehensive Financial Report (ACFR) Rates of return presented are calculated using a time-weighted rate of return methodology based upon market values and are presented gross of investment management fees. |

|||

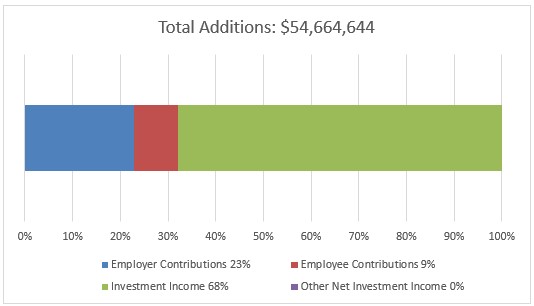

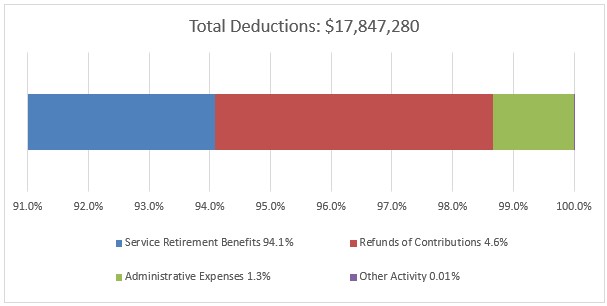

Pension Additions Deductions.xlsx - 20 KB

Pension Additions Deductions.xlsx - 20 KB

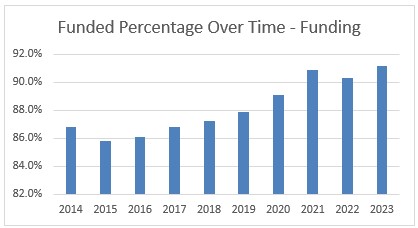

Pension Funded Percentage Data.xlsx - 19 KB

Cross Reference of City of College Station Specific Information found in TMRS documents:

- Plan Provision Chosen - PDF | pages 82-84

- Schedule of Changes in Fiduciary Net Position 2023 - PDF | page 14

- Schedule of Changes in Fiduciary Net Position 2022 - PDF | page 14

- Schedule of Changes in Fiduciary Net Position 2021 - PDF | page 16

- Schedule of Changes in Fiduciary Net Position 2020 - PDF | page 27

- Schedule of Changes in Fiduciary Net Position 2019 - PDF | page 27

- TMRS - Actuarial Valuation Results 2023 - PDF | page 21

- TMRS - Actuarial Valuation Results 2022 - PDF | page 17

- TMRS - Actuarial Valuation Results 2021 - PDF | page 17

- TMRS - Actuarial Valuation Results 2020 - PDF | page 21

- TMRS - Actuarial Valuation Results 2019 - PDF | page 21

- Texas Comptroller of Public Accounts Public Pension Search Tool

- Governmental Accounting Standards Board Pronouncements