Traditional Finance

FINANCIAL SUMMARY

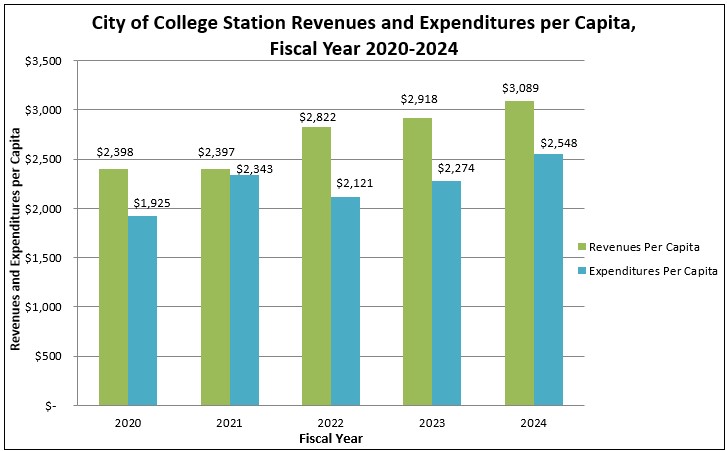

The following summary data is from the City’s government-wide financial statements in the Annual Comprehensive Financial Report. The government-wide Statement of Activities is designed to give readers with a broad overview of the City’s finances, in a manner similar to a private-sector business, accrual basis of accounting. Accrual basis of accounting recognizes Revenues when earned and expenses are recognized at the time the liability was incurred.The per capita figures are based on the City’s 2024 estimated population of 129,714.

| Fiscal Year 2024 | Per Capita | |

| Revenues and Transfers: | ||

| Governmental Activities: | ||

| Ad valorem tax | 70,753,123 | 545.45 |

| Sales tax | 41,857,656 | 322.69 |

| Program revenue | 44,257,572 | 341.19 |

| Other revenues | 24,355,261 | 187.76 |

| Transfers | 15,739,089 | 121.34 |

| Total Governmental Activities | 196,962,701 | 1,518.44 |

| Business-type Activities: | ||

| Program revenues | 207,793,007 | 1,601.93 |

| Other revenues | 8,599,143 | 66.29 |

| Transfers | -15,739,089 | -121.34 |

| Total Business-type Activities | 200,653,061 | 1,546.89 |

| Total Revenues | 397,615,762 | 3,065.33 |

| Expenses: | ||

| Governmental Activities | 154,840,657 | 1,193.71 |

| Business-type Activities | 175,695,103 | 1,354.48 |

| Total Expenses | 330,535,760 | 2,548.19 |

| Change in Net Position | 70,100,949 | 540.43 |

| Other Information: | ||

| Fiscal Year 2022 Budgeted full-time equivalent positions |

1048.5 |

Traditional Finances Rev Exp.xlsx - 19KB

BUDGET

A budget serves as the financial plan for the City. It is presented by fund and is designed to provide decision makers with an overview of City resources and how resources are utilized to accomplish the policy direction of Council. The budget shows the City’s commitments and how the City meets the financial policies approved by Council. The document is also designed to show services provided and associated costs.>> View budget reports

QUARTERLY SUMMARY FINANCIAL STATEMENTS - BUDGET BASIS

These Financial Statements are prepared on a Quarterly Basis for management to recognize and address any concerns. The Statement present a summary of activity on all the major operating funds in correlation with the current Budget and comparison to prior year Quarterly Financial Statements.>> View FY25 Quarter 3 Summary

>> View FY25 Quarter 2 Summary

>> View FY25 Quarter 1 Summary

>> View FY24 Quarter 3 Summary

>> View FY24 Quarter 2 Summary

>> View FY24 Quarter 1 Summary

>> View open checkbook

>> View the reports

>> Search unclaimed property

>> View FY25 Quarter 1 Summary

>> View FY24 Quarter 3 Summary

>> View FY24 Quarter 2 Summary

>> View FY24 Quarter 1 Summary

CHECK REGISTER

The City Check Register includes Payments to vendors for goods and services, payments to agencies per contractual terms and conditions, Travel reimbursements to employees and Refunds for deposits on utilities, facilities rentals, etc. The register does not include payroll checks and excludes checks that might provide protected privacy information, such as child support, and deferred compensation.>> View open checkbook

ANNUAL COMPREHENSIVE FINANCIAL REPORT (ACFR)

This report provides detailed information concerning the financial condition, health, and activities of the City. It includes a balance sheet, statement of changes in financial position, statement of revenues and expenses, and comparison of budgeted to actual expenses and revenues.>> View the reports

UNCLAIMED PROPERTY LIST

The City of College Station is currently holding more than $340,408.00 in cash waiting for the rightful owners to claim. One in four Texans has unclaimed property from forgotten bank accounts, uncashed checks, security deposits and utility refunds. It’s your money and we want you to get it back.>> Search unclaimed property

Current FY 2025 - Budget Links

Budget - Revenue (Interactive): Revenues | City of College Station Revenues (socrata.com)

Budget - Revenue (Downloadable Raw Data): Open Budget Revenue Master Dataset 2024.xlsx

Budget - Expenses (Interactive): Expenses | City of College Station Expenses (socrata.com)

Budget - Expenses (Downloadable Raw Data): Open Budget Expenditures Master Dataset 2024.xlsx

Current FY 2024 - Check Register Link

Check register: Ledger | City of College Station Open Checkbook (cstx.gov)